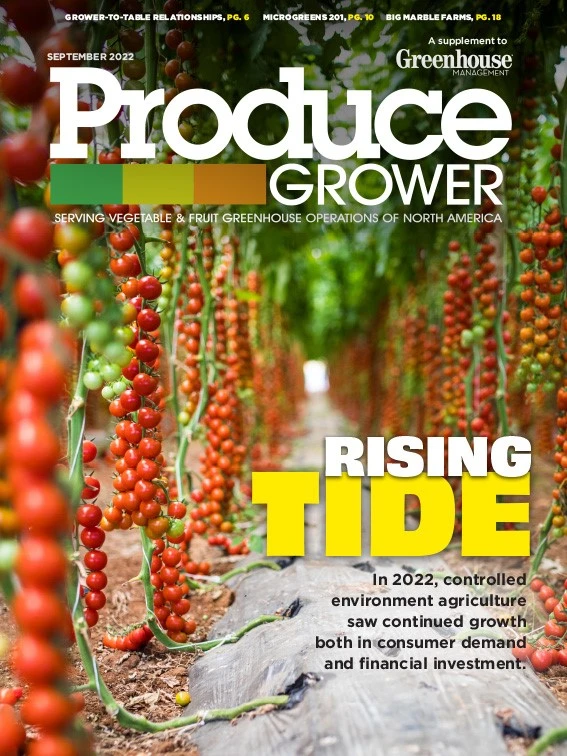

2022 has been a year of growth for controlled environment agriculture.

For consumers, more and more greenhouse-grown products are hitting grocery store shelves. In addition to tried-and-true crops like cucumbers, leafy greens and herbs, more strawberries from indoor growers are available for different retailers. Strawberries continue to be a crop to watch, with Driscoll’s partnering with indoor farming company Plenty this year to begin growing Driscoll’s berries indoors.

More crops are on the horizon too, with various growers working to develop ways to produce spinach, different kind of berries and other produce items in a sustainable, cost-effective way. Pure Flavor, a Canadian operation, bring what it says the first greenhouse-grown melon to market. Bowery is working with CEA-seed company Unfold to develop several new crops, starting with a trial of new Romaine blends next year.

For businesses themselves, the year has seen several companies expand. For example: Revol Greens, a Minnesota-based operation, recently competed its expansion into Texas. Gotham Greens announced plans to double its product space. Vertical farm company Oishii opened a 74,000-square-foot farm in Jersey City dedicated just to strawberries.

Others have raised significant amounts of money to grow their business. Little Leaf Farms, for instance, secured $300 million in new funding that it says will fuel new expansion plans. Kalera, a vertical farming company, went public via a SPAC deal and had an initial value of $375 million.

So what comes next? It’s hard to predict. What is clear that the CEA space is evolving and changing in real time. Below, various industry leaders, business owners and researchers share their thoughts about where the industry is at, where it’s going and more. We’d like to hear your thoughts, too. Drop us a line at cmanning@gie.net and let us know what’s happening with your business. – Chris Manning

GENE GIACOMELLI, PROFESSOR & EXTENSION SPECIALIST, THE UNIVERSITY OF ARIZONA

“I think CEA is in a great space. I think it’s the greatest it’s been in the 42 years I’ve been in academia.

But it’s a crazy space. It used to be really organic. And by that, I mean in that it was organic by people in the agriculture industry that loved what they did and were doing the best they can to expand their businesses. They’d grow a little bit at a time by starting up a couple thousand square feet and ... maybe get to more than an acre. I am sure there are still plenty of those, but they aren’t making the news. The news is all this big money that, I would say, comes from the finance people realizing that agriculture can be a good investment — particularly in the high-tech environment of controlled environment agriculture. The challenge is always to grow a crop economically and make a profit, but there’s always potential for that. So they are investing into the technologies that give them the best opportunities to succeed. And I think that’s positive for the industry in that it’s raising the bar.”

JOHN GREEN, CO-FOUNDER & CEO, REVOLUTION FARMS, CALEDONIA, MICHIGAN

“I don’t know the exact numbers, but I know that less than 10% of all lettuce is grown in some form of alternative farming, whether that be hydroponic or vertical or whatever it is. I think there’s a lot of stats to support this, but I think this is very quickly going to be 20%, maybe 25%. We saw the same thing in craft beer. The goal there was originally 25% by 2025 and thought there was no way. And then it just absolutely took off.

I think that what’s really going to drive this is this localization of growers. Even the big boys — and I don’t consider us one of the larger groups ” they have a model where they have multiple growing facilities around the country. With craft beer, it’s the tap rooms. There’s definitely a connection to community that’s important to people. Even consumers’ needs are very different. There’s a reason you’ve got West Coast IPAs that are different than East Coast IPAs. Well, you might see that in the produce world as well over time in terms of the taste.”

JEFF RICHARDSON, VICE PRESIDENT OF SALES, GREAT LAKES GROWERS, ONTARIO, CANADA

“Yes, it’s a challenging time. The costs are the costs, right? Everything has gone up. Every item in this greenhouse — whether it be labor, PLUs, palettes — it’s all gone up. So the return, if you look at the return compared to last year, hasn’t gone up. But you just have to keep pushing through.

[This industry] is changing in front of us. We are eating better as a society. I look at it with my girls. Their day-to-day snacks, it’s not what I had as a kid — Oreo cookies or whatever. And don’t get me wrong: they still have their treats. But they want mini cucumbers or peppers cut up. They are asking for that. They almost always pick a fruit or a vegetable over a sweet. The volumes are getting quite large. You need a consistent, quality supply and if you’re relying on something that’s impacted so quickly by an environmental problem, it’s a problem. I think that’s why the greenhouse space is becoming so much more attractive for investors and the general public.”

MAT WALSH, CFO, MUCCI FARMS, ONTARIO, CANADA

“The growth potential is enormous. I think as populations grow and food resources change and the retailers and customers attention to quality and consistency and taste continue to evolve, I think more and more retailers will start learning on controlled ag growers as their source for produce. I think we’ve seen it in our business in the last five years that we have started to take substantial shelf space from field-grown suppliers because retail can depend on us year-round to provide large quantities of high-quality, consistent produce.”

VIRAJ PURI, CO-FOUNDER & CEO OF GOTHAM GREENS, NEW YORK CITY

“Overall, the industry is seeing strong and growing demand, but like the overall economy, it also is facing challenges related to inflation. Costs are up across the board and labor availability can be an issue in various markets. We continue to see a bright and promising future for the ‘greenhouse-grown’ produce category. Growing produce indoors certainly has an increasing role to play in the future of sustainable food production. And while indoor farming may not represent the future of all fresh produce production, for certain types of crops, it will become more prevalent. There is an incredible value proposition of growing highly perishable fresh produce near large population centers while using fewer natural resources. Architects, developers and urban planners are increasingly seeing value and interest in integrating food production into the built environment. We’re excited to see the growth of controlled environment farming companies and technologies worldwide.

As consumers increasingly demand more transparency in how and where their food is produced and pay more attention than ever to the food they consume and its impact on the planet, the demand for safe, clean, greenhouse-grown produce and plant-based fresh foods will only continue to gain momentum next year and beyond.”

NEIL MATTSON, PROFESSOR AND EXTENSION SPECIALIST, CORNELL UNIVERSITY

There has been significant investment in CEA. For instance, there was $2.3 billion invested in novel farming systems in 2021 when AgFunder Global Investing Report was released, which represents a 77% increase over 2020. Bowering Farming Inc.’s $300 million investment topped the AgFunder investment list, followed closely by Infarm ($200 million), Local Bounti ($200 million) and 80 Acres Farms ($160 million). And that doesn't include big announcements this year such as $300 million to Little Leaf Farms and $400 million to Plenty. While there are new companies entering the space, I see existing companies becoming larger, building new, larger farms and serving new-to-them regions.

In terms of research, watch for strategies to reduce energy through efficient lighting and lighting control, interest in enhancing the flavor of CEA grown products, and bringing new types of CEA products to market such a new leafy greens (like spinach and romaine) and more fruiting crops, among others.”

Explore the September 2022 Issue

Check out more from this issue and find your next story to read.

Latest from Produce Grower

- PG CEA HERB Part 2: Analyzing basil nutrient disorders

- University of Evansville launches 'We Grow Aces!' to tackle food insecurity with anu, eko Solutions

- LettUs Grow, KG Systems partner on Advanced Aeroponics technology

- Find out what's in FMI's Power of Produce 2025 report

- The Growth Industry Episode 3: Across the Pond with Neville Stein

- The Growth Industry Episode 2: Emily Showalter on how Willoway Nurseries transformed its business

- 80 Acres Farms expands to Georgia, Texas and Colorado

- How BrightFarms quadrupled capacity in six months