2023 was a year of change for the broader controlled environment agriculture market. Many new products — including several salad kits — were launched. Some companies embarked on ambitious expansion plans; Gotham Greens, for instance, added a second facility in Colorado. There were also acquisitions, including Pure Flavor acquiring tomato producer MightyVine in a play to expand their footprint in the Midwest.

There were challenges, too. Some companies came and went. Others, most publicly AeroFarms, navigated financial hardships and have restructured to enter new eras of business. New energy codes in California also portend stricter regulatory standards for future new builds — perhaps adding to already capital-intensive business costs.

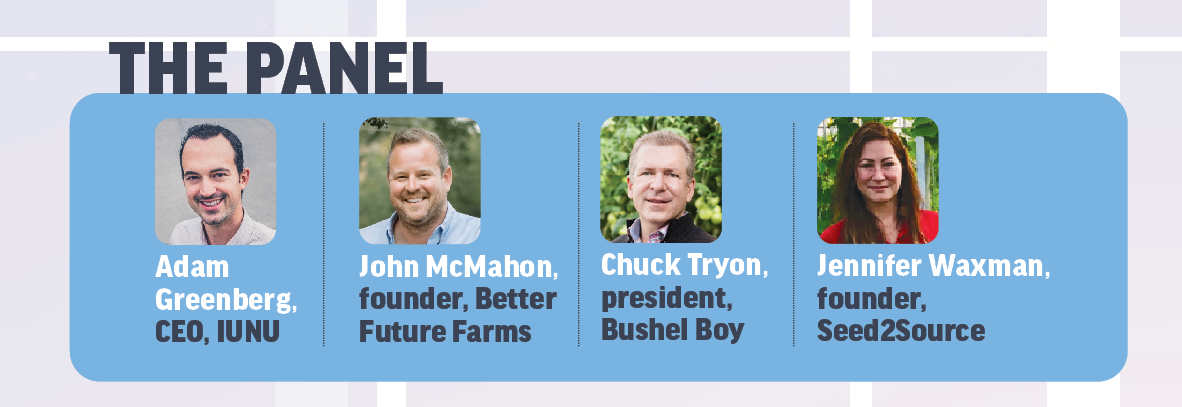

So where is the CEA market headed in 2024? Produce Grower asked a panel of industry stakeholders a set of questions about the current state of the industry, where it’s headed, the top stories of 2023 and more. If you have your own answers to these questions, be sure to share your opinion to krodda@gie.net.

— Chris Manning

WHAT WAS THE BIGGEST CEA STORY IN 2023?

Adam Greenberg: The biggest story in CEA was the sobriety served to the industry by forcing companies to add real value, not just marketing. Only the profitable will survive the next few years given the higher interest rates, and an increase in purchasing power of consolidated retailers. 2023 will be remembered as a transition year as we moved from “growth at all costs” to a “profitable growth” model.

John McMahon: It’s a totally different landscape now than it was a year ago. We’ve had some pretty large bankruptcies, so we’ve seen challenges with vertical farms and some greenhouses like AppHarvest. Still seeing lots of growth — lots of demand, I think. But it would be harder now for new entrants. I think the capital markets would be really hard right now to go out and raise money for a new venture.

Chuck Tryon: The last year has been one of significant change across controlled environment agriculture. Change and struggle for many as a number of companies have faced different challenges — growth challenges, financial challenges, plant health challenges, consumer demand challenges. So the challenges are plentiful. But the opportunities are also still plentiful. I view last year as a transitional point, and what’s coming out the other end of this is the reality that CEA is still farming. At the end of the day, we are growers, we are farmers. And while there is incredible technology that comes into this space, it comes in to support the farming and growing aspects of this business. The more we and other companies recognize that and stay focused on growing the best quality products we can the most efficient way we can and meeting consumer demand, then we’ll all be more successful.

Jennifer Waxman: The collapse of the CEA operations that we in the industry knew were going to collapse, that took all of the VC money and had no leadership in the space. We knew it was going to happen. But I don’t think anyone thought it was going to happen at the exact same time. ...

The intentions of these companies, what they sold investors and what they sold the public to what their mission and vision was vs. [reality] stands out as the biggest story in 2023. The biggest issue is having a bunch of suite-level, successful businesspeople that felt that they could just apply that know-how to agriculture and be successful. That’s the biggest misstep and we — those who have been in the industry — we all saw the red flags when you look at the leadership and who was brought into the teams. No one in most of these failed attempts came from agriculture.

WHERE IS THE INDUSTRY AT FINANCIALLY; WHAT ARE THE CHALLENGES AND OPPORTUNITIES WHEN IT COMES TO MONEY?

AG: Financially, the industry is strong where it has figured out labor and marketing. Whether it is a strong labor program like greenhouses in Canada or automation systems like they have in lettuce, growers are finding ways to make the dollar stretch further. Consumer demand far outstrips supply for fresh local produce at normal prices. Current prices require automation and scale to maintain their consumer allure compared to outdoor crops.

JM: It is what it is right now. Most people seem to be slowing down — and this is not specific just to CEA. I was looking at the Wall Street Journal [recently] and it had a story about how distribution was on a tear and now it’s dying. Other than a few select markets, the capacity is built out. ... It’s different in the greenhouse space based on product. But ultimately, these are large capital projects. The cost of capital is super important, so interest rates have a huge impact on large capital projects. And as interest rates go up, it makes the industrial returns go up because the cost of capital they are deploying goes up, so they have to get higher returns.

CT: The challenges that I see are really having a good idea of what your value proposition is. What customers are they focused on? What are they really in business to do? And how do they best develop a strategy around that? For me, financing is tied to a vision a company has, but also the reality of knowing who they are and what makes them different.

There’s going to be continued challenges. But I think as companies really focus in on the understanding that we are growers, that we are farmers, this is agriculture and that technology enables it. But it’s not a technology business. It’s an agricultural business enabled by technology, and I think that realization is what’s starting to settle the waters and will make it clear who will continue to thrive in this industry and who may be challenged. There have been very few surprises.

JW: I think that, depending on what your funding is, there’s a bad taste in a lot of financial institutions’ mouths. You still have private banks that are willing to take the risk on smaller- to medium-sized operations off the get-go. I can speak firsthand to that because I’m in the middle of that. You’ve got VCs that still believe in the future of food and that have domestic supply, so they are a little less intimidated with providing capital to a really well-baked business model. I see more financial institutions looking for more of those in the specialty realm than a commodity realm, too. We’ve got a lot of wonderful leafy green growers, but that’s about all we have as far as success measures. Through my own ventures and the ventures of clients we represent, specialty is the game right now. There’s more risk taking in capital markets for specialty.

WHAT IS THE BIGGEST TOPIC YOU ARE WATCHING FOR IN 2024?

AG: Interest rates will dictate the growth of new builds as well as inflation throughout the supply chain. As interest rates remain high, access to capital in the short term becomes challenging. Yet, for the long term, growers that manage to invest in automation to lower costs — and subsequently, highly leveraged technology like AI — will have a long term and lasting advantage. Of course, the digital supply chain (data storage and distribution) is also affected by high interest rates.

JM: For us, we are super excited to launch with Taylor Farms and get our product out. We saw some of the packaging recently and it’s super cool. It’s going to be super cool to see it out on the retailer shelves. We’ve worked so hard behind the scenes and I’m so excited to bring this project to life and see it all come together and build the team out. ... Generally, I hope there’s more positive stories in the space. I’m rooting for other companies, too. I really believe in CEA. I really believe in the product and the technology and love high-tech greenhouses. And there’s a lot of people that need to be fed and I want to see more successes in 2024. It’s critical for the industry.

CT: For the company, it’s continued innovation on two fronts. It’s on the product side, continuing to bring in new products where he can bring value to our best customers. But it’s also innovation on the technology side. We’ve got some exciting things we are working on to help enable the management of our greenhouses, the growing of our product in our greenhouses and working with some really good partners to bring in new technology — whether that’s how we manage the crop, how we take care of our facility, how we sanitize.

For the industry, I think there’s a little bit of making sure everyone in the industry is focused on their core business. I don’t think you’ll see as much new capacity coming into play. I think you’ll see some changes in who owns the capacity, but I don’t think you’ll see as much new construction happening, at least within North America.

JW: I hope [we see more] narratives. I haven’t seen narratives — only product. We have year-round products that are chemical free. There is no story as to why — we’ve lost that. And that’s made it hard for us to define CEA as a new category, particularly in the B2C retail markets. That brings confusion. We haven’t carved out what CEA means and have not demonstrated what CEA is to the public. We have not defined who we are and I hope we do in 2024.

"I view last year as a transitional point, and what’s coming out the other end of this is the reality that CEA is still farming." - Chuck Tryon

WHAT IS THE INDUSTRY’S BIGGEST OPPORTUNITY FOR 2024 OR BEYOND?

AG: The biggest opportunity is for growers to harness the power of years of historical data to drive productivity and meet consumer demand at the right price.

JM: Demand is still high for CEA. I’m really focused on lettuce, to be clear — every crop is a little different. Lettuce is still such a small percentage of the overall lettuce production in the U.S. The demand and the volume are there considering. The opportunity is to get better at greenhouse designs and operations and become leaner, more capital efficient in production or more disciplined with capital deployment. The closer we get to field lettuce in terms of cost parity, the sky’s the limit.

CT: The biggest opportunity is differentiation of products. I think there’s a significant opportunity to produce more premium and more unique types of products, different varieties that offer different aspects. Those who are the most efficient will be those who continue to succeed, but at the end of the day, we all need to differentiate ourselves from each other to bring more variety and opportunity to consumers.

JW: Vertical integration, mergers and acquisitions and just overall alliances are going to be what the industry needs. And many of the big and small guys are in talks right now for 2024. ... We are still a small industry. We are competing against each other instead of banding together. Everyone thinks they have this proprietary growing technology — that’s all BS. So we’re starting to get a little more real in how we present ourselves and companies are starting to talk to each other. This was taboo and companies are realizing that not talking to each other doesn’t work anymore. We have to come together because we are not our competition — it’s every other type of growing outside of us.

WHAT IS THE INDUSTRY’S BIGGEST CHALLENGE?

AG: The biggest challenge in the industry is labor — the price of labor, and the consolidation of expertise. The industry needs a centralized database of knowledge. Using pen and paper for documentation is a lost opportunity.

JM: Over the last 10 years, there’s been a lot of excitement, press, capital and more going into the space. I think some people that came into the industry thought it was easy and they’d print money, that it’s AI and everything is solved. In reality, this is farming. What can go wrong will go wrong at some point. It’s hard to find labor — it’s still physical and hands-on despite the automation. The perception of the industry is that because of technology, it’s easy and tech mitigates all the risk. But it’s a tough business, whether you’re farming outside or in a greenhouse.

CT: Biggest challenge is going to be the continued inflation as it affects the most critical components of our cost structure. Labor, electricity, all forms of energy. Packaging costs, too. That will continue to be the biggest challenge we face and that most of the industry will face.

JW: One of the biggest challenges that still occurs (and I hope people are waking up to it) is this whole ‘build it and they will come’ mentality. Which is why a lot of companies have failed. It doesn’t mean they have a great product, they just had the first person sign up with them to monopolize their inventory. That’s starting to change. Energy and labor, too — skilled labor especially. Academia is not there yet.

WHO ARE SOME PEOPLE AND COMPANIES YOU ADMIRE?

AG: Dr. Charlie Hall is always prepared to collaborate and brings an insightful and data-driven approach to the industry. On the company side, there is a decent amount of innovation happening in outdoor agriculture — Carbon Robotics comes to mind.

JM: There are a lot of very smart people in the space. Some of the smartest people don’t always get the most recognition. I’m constantly learning from so many people. ... Little Leaf Farms is doing a great job. Gotham Greens seems like it’s doing a great job. Sara Farms in Japan — I love those guys and what they are doing is awesome.

CT: One that we look at is Little Leaf Farms. What I admire about what they’ve done is, to me, they know who they are. They know what products they are going to stay focused on and they know what geographical area they stay focused on. And we admire that because, in many ways, that’s how we approach it.

JW: Viraj Puri from Gotham Greens — their model is the exact model we based our large CEA build on. And that’s having agricultural know-how and layering in the technology only as needed. They’ve grown slow, steady and solid. Little Leaf Farms is making a killing. They are one of the top, have a great leadership team and come from agriculture. Revol Greens — a great team with good growers, fun marketing and a bit of a narrative. And for specialty, I have to put some respect on Smallhold for putting a name on gourmet mushrooms.

Explore the February 2024 Issue

Check out more from this issue and find your next story to read.

Latest from Produce Grower

- TIPA Compostable Packaging acquires paper-based packaging company SEALPAP

- Divert, Inc. and General Produce partner to transform non-donatable food into Renewable Energy, Soil Amendment

- [WATCH] Sustainability through the value chain

- Growing leadership

- In control

- The Growth Industry Episode 8: From NFL guard to expert gardener with Chuck Hutchison

- 2025 in review

- WUR extends Gerben Messelink’s professorship in biological pest control in partnership with Biobest and Interpolis